- Concise Crypto Newsletter

- Posts

- Enzyme Finance - Decentralized digital asset management

Enzyme Finance - Decentralized digital asset management

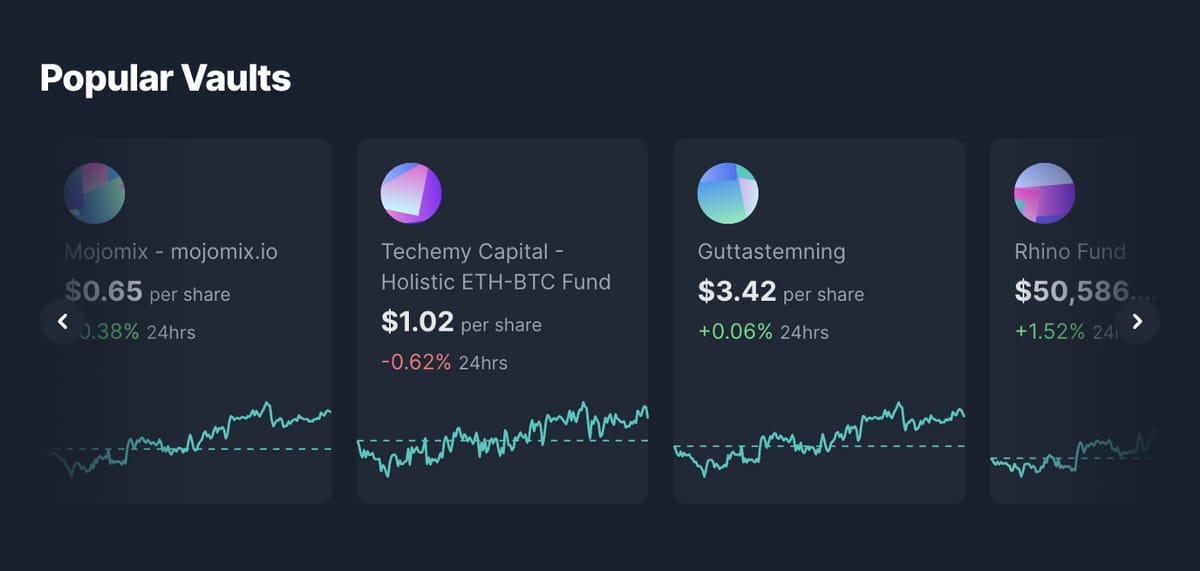

Find a vault and invest in crypto like you would an ETF or mutual fund.

Enzyme Finance (MLN)

What is Enzyme Finance?

Enzyme Finance is a decentralized digital fund marketplace built on the Ethereum network. It uses a set of smart contracts to allow users to create, invest, and manage different on-chain assets which they refer to as Vaults.

Why does Enzyme Finance have value?

Enzyme was one of the first protocols to attempt to decentralize traditional financial markets. When it launched, under the name Melon, in 2017, the DeFi ecosystem was still a dream. It was a first-mover and allowed for ways to create different financial products in crypto including robo investing, ETF’s, market making and more. Now Enzyme is used to create or find DeFi ‘funds’ or ‘vaults’ where you can invest in on-chain assets that are similar to ETF’s or mutual funds.

What are the benefits of Enzyme Finance?

● It decentralizes and allows investments that are gated or restricted in traditional finance.

● They partner with many of the major DeFi protocols in crypto.

What are the disadvantages of Enzyme Finance?

● Despite being one of the first DeFi protocols to be created it hasn’t gained wide market share (roughly $200M AUM).

● Ethereum congestion can hinder its performance.

What are MLN’s tokenomics?

The total supply of MLN is 1,824,437. 599,400 were distributed in the ICO. There are currently over 1.7 million in circulation.

Who founded Enzyme Finance?

Mona El Isa and Rito Trinkler.

Who are Enzyme Finance’s investors?

Enzyme Finance has conducted one funding round. The main investors are Placeholder, Defiance Capital, KR1, and Kenetic Capital.

Concise Crypto Grade:

C+ :In theory Enzyme Finance is a really unique and rewarding crypto solution. It allows users to hedge some of their crypto volatility by creating or joining a vault that is made up of multiple DeFi tokens. However, without additional liquidity many of the vaults can be more volatile than investing directly in a particular DeFi asset. There are a few gems within the Enzyme ecosystem but for right now we need to see more liquidity and additional vaults before we can give it a higher grade.

Where can I buy MLN?

Coinbase Exchange, Binance, Huobi Global, Gate.io, KuCoin, Kraken.

What ecosystem does Enzyme Finance run on?

Ethereum