- Concise Crypto Newsletter

- Posts

- Uniswap - A decentralized exchange you should know

Uniswap - A decentralized exchange you should know

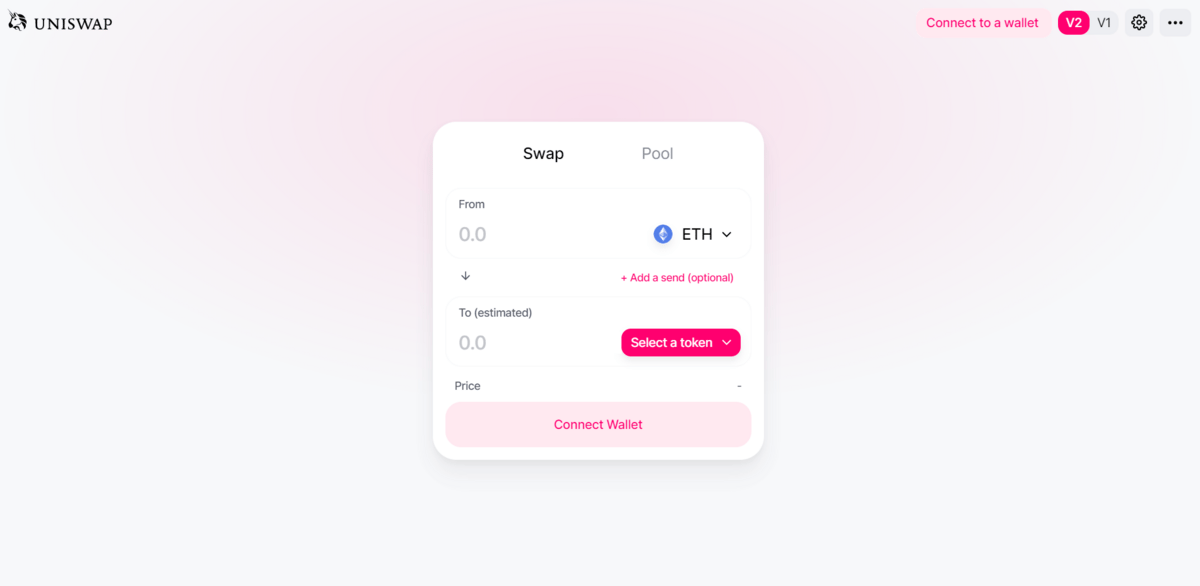

A super easy way to trade tokens.

Uniswap (UNI)

What is Uniswap?

Uniswap had been one of the main drivers of the decentralized finance (DeFi) boom. It launched in November 2018 but started being widely used in early 2020. It allows you to swap cryptocurrency that may not be listed on a centralized exchange. It is also the first decentralized exchange (DEX) to implement the Automated Market Maker (AMM) model taking a twist from previous decentralized exchanges.

It introduced Liquidity Pools, an algorithm where users can stake equal parts of a token pair to provide liquidity for traders to execute instant transactions.

Why does Uniswap have value?

Uniswap has value because it allows users to trade a variety of cryptocurrencies that aren’t listed on centralized exchanges. In addition, it’s ‘new’ AMM model provides instant liquidity and allows the Uniswap community to earn fees for providing liquidity. More people get more access to crypto through Uniswap and that value cannot be understated.

What are the Pros of Uniswap?

● Staking rewards

● Any person can participate as a market maker (provide liquidity)

● It's easy to introduce new token pairs so developers can add their own tokens

What are the Cons of Uniswap?

● High fees due to Ethereum congestion

● Price variations in staked assets can lead to money loss (slippage)

What are UNI’s tokenomics?

UNI's maximum supply is 1 billion tokens, to be distributed among the community and development team over the next 4 years. After that time, the protocol will introduce a 2% inflation to encourage users to participate in the network.

83,333 UNI are allocated in Liquidity Pools every day, with a minting rate of 13.5 UNI per block to be distributed among Liquidity Providers.

Who founded Uniswap?

Hayden Adams founded Uniswap in 2018 after Ethereum creator Vitalik Buterin proposed the idea.

Who are Uniswap’s investors?

Uniswap had conducted various funding rounds. It’s investors are Andressen Horowitz, ParaFi Capital, Rockaway Blockchain Fund, Adam Morley, Variant Alternative Income Fund, Spark Capital, Version One Ventures, A Capital Ventures, SV Angel, and NON-fungible Chan.

Concise Crypto Grade:

A+ : Uniswap is THE decentralized exchange. One of the best DEX’s on any blockchain it has high liquidity, a multitude of coins, is easy to use, and is accessible from anywhere with an internet connection. If you are new to crypto and looking to get started with trading or investing in crypto as some point you’ll come across Uniswap.

Where can I buy UNI?

Uniswap protocol, Coinbase, Binance, Kraken, Gemini

What ecosystem does Uniswap run on?

Ethereum